take home pay calculator maryland

Next divide this number from the annual salary. It can also be used.

Maryland Salary Paycheck Calculator Gusto

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and.

. Web The Maryland Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022. Web Use this Maryland gross pay calculator to gross up wages based on net pay. Paycheck Results is your gross.

Our calculator has recently been updated to include both the latest. Web Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Below are your Maryland salary paycheck results.

Web Maryland Income Tax Calculator 2021. Web This net pay calculator can be used for estimating taxes and net pay. Web Maryland Salary Paycheck Calculator Results.

Your average tax rate is 1198 and your marginal tax rate is 22. Supports hourly salary income and multiple pay frequencies. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the.

This allows you to review how Federal Tax is calculated and Maryland State tax is calculated and how those. This free easy to use payroll calculator will calculate your take home pay. Supports hourly salary income and multiple pay frequencies.

Web Calculate your Maryland net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. Web You will need to pay 6 of the first 7000 of taxable income for each employee per year which means that your tax is capped at 420 per employee. This free easy to use payroll calculator will calculate your take home pay.

Simply enter their federal and state W-4. Web The net pay calculator can be used for estimating taxes and net pay. Due to changes to the Federal W-4 form in 2020 there are now two versions of the Net Pay Calculator available.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Just enter the wages tax withholdings and other. Web First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Maryland. Web Use ADPs Maryland Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. If you make 70000 a year living in the region of Maryland USA you will be taxed 11612.

You can alter the salary example to illustrate a different filing status or show an alternate tax year. This is only an approximation. The results are broken up into three sections.

Well do the math for youall you need to do. Web This 9000000 Salary Example for Maryland is based on a single filer with an annual salary of 9000000 filing their 2022 tax return in Maryland in 2022. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Maryland.

Web Your Details Done. Web You are able to use our Maryland State Tax Calculator to calculate your total tax costs in the tax year 202223. Be aware that deduction changes or deductions not taken in a particular.

Indeed Salary Calculator Indeed Com

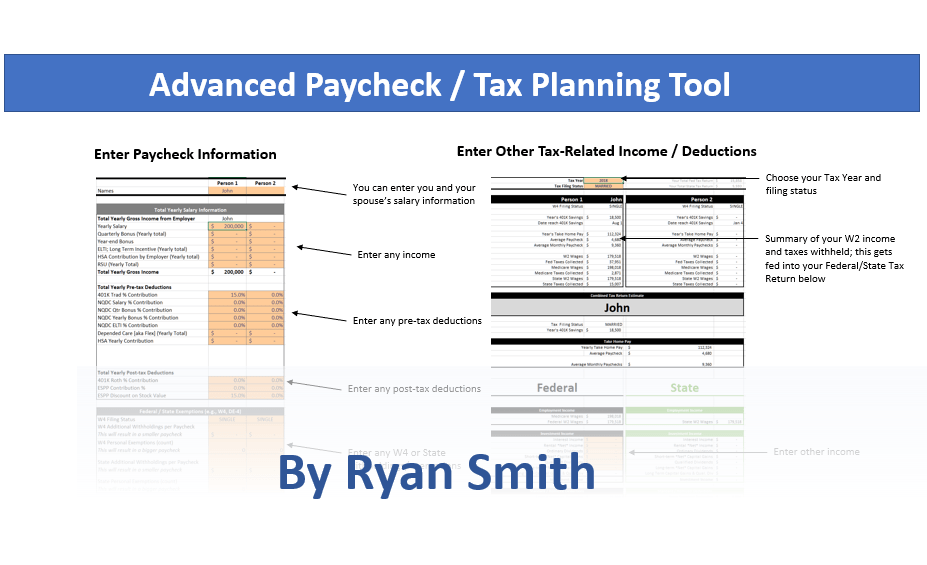

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

Maryland Salary Calculator 2022 Icalculator

New State Application Requirement For Montgomery County Maryland Property Tax Credits Miller Miller Canby

-1.1_20220324.jpg)

Investment Options Maryland 529

Claimant Most Frequently Asked Questions Division Of Unemployment Insurance

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Maryland Salary Paycheck Calculator Gusto

Maryland E Zpass And Pay By Plate Home Driveezmd Com

![]()

Income Tax Calculator 2022 Usa Salary After Tax

Indeed Salary Calculator Indeed Com

Maryland Income Tax Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

Here S How Much Money You Take Home From A 75 000 Salary

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Take Home Paycheck Calculator Hourly Salary After Taxes

Worcester County Md Coronavirus Covid 19 Information 2022

Free Online Paycheck Calculator Calculate Take Home Pay 2022